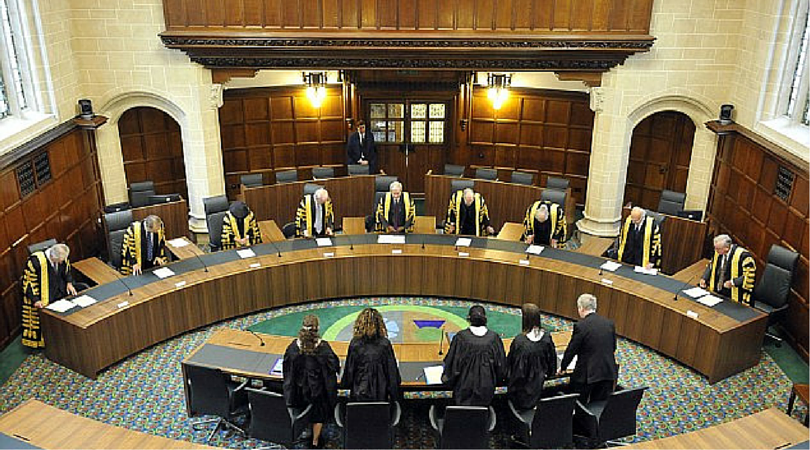

Property owners, and others, will be very relieved following a decision handed down today by the UK Supreme Court in respect of a property undergoing alterations.

The case concerned an office building in Sunderland that was undergoing works by the owner to convert the first floor from one office suite to three. The owner of the property had originally sought a nominal value during the works and this had been confirmed by the Upper Tribunal (Lands Chamber). However, the Valuation Office Agency (VOA) appealed to the Court of Appeal. The Court of Appeal determined that the property had to be valued in an assumed “reasonable state of repair” despite the works that were going on. The tests set by the Court of Appeal judges in that were entirely retrospective ones:

1. Is the property in a worse condition than it once was? If so it is in disrepair.

2. Are the works that would be required to make it capable of beneficial occupation for its earlier use works of repair?

3. Would a hypothetical landlord (not the actual landlord) have considered it economic to carry out those works at the relevant valuation date? The valuation date for the 2010 Rating List is 1 April 2008.

The Court of Appeal had said that if the answer to all these three questions is yes then the property has to be valued in an assumed reasonable state of repair for its former use, regardless of its actual condition.

The ratepayer was granted leave to appeal to the UK Supreme Court against the Court of Appeal decision and both the Rating Surveyors’ Association and the British Property Federation acted as “interveners” in the appeal.

The unanimous judgment from the Supreme Court has determined that the works of alteration cannot be ignored, and that the assessment should be reduced to a nominal figure during those works. The Supreme Court described the approach adopted by the Court of Appeal as “novel”, but not one that could be supported. The fact was that the property was not capable of beneficial occupation, for any purpose, during the works and it was therefore correct that the value should reflect this.

The Supreme Court allowed the ratepayer’s appeal for four reasons. Firstly, the law of rating has a long-established principle of treating things as they actually are – the “reality principle”. Secondly, the statutory assumptions about state of repair did not remove the initial question of whether the property is capable of beneficial occupation. Thirdly, the Valuation Officer’s task was to make an objective assessment of whether the property was capable of occupation given the works and, finally, there was no statutory bar to applying a nominal assessment to reflect the actual position.

The Court’s detailed judgment approved the previous VOA guidance, which took account of an owner’s works to change the use or occupation of a property. The Court considered concerns about potential for empty rates avoidance by owners commencing works, but not completing them, and commented that the Rating (Empty Properties) Act 2007, which introduced 100% empty rate liability, allowed the Secretary of State to introduce anti-avoidance measures. The Supreme Court noted that there had, to date, been no need for such measures but that they could be introduced if the Court’s ruling gave rise to such abuse.

The Supreme Court decision does not remove the assumed “reasonable state of repair” when valuing for rating purposes, but it will allow a nominal value to be applied in circumstances where substantial works are going on. This will be a considerable relief for property owners and developers. It will also help make alteration and refurbishment of properties more affordable by removing empty rate liability that might otherwise have been imposed based on the previous Court of Appeal rules.

This is a victory for common sense and for the principle that non-domestic rates should be a tax on the value of occupation of property, not its potential occupation.