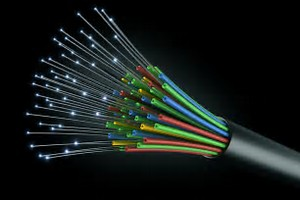

The Government has launched a consultation on draft regulations intended to introduce 100% relief from business rates for new fibre optic telecommunications networks installed after 1 April 2017. The consultation will run for 12 weeks from 29 August 2017. The consultation does not seek views on: the policy of granting this relief; who should be eligible for the relief; when the relief should apply; or how long it should apply for. Instead, the consultation seeks views on whether the regulations effectively put into place the relief that has been announced.

The relief is for new fibre optic networks created from 1 April 2017 onwards. It will not apply to networks that existed at that date, regardless of whether those fibres were in use at that date (so called “lit” fibres) or existed but were unused (so called “dark” fibres). This will mean that it will be more rates efficient to create new fibre networks after 1 April 2017 than it would be to bring into use dark fibre that already existed at that date, but was unused. That seems an odd outcome. It may also lead to concerns for those businesses with dark fibre in place at 1 April about unfair competition from new fibre networks created after 1 April 2017. The consultation does not mention EU “State Aid” restrictions, presumably because Government is no longer concerned with these having triggered Article 50 of the Treaty of Lisbon.

The rates relief for qualifying new fibre will be 100% relief and will apply until 1 April 2022, which is the date of the next proposed rating revaluation, although it could presumably be extended beyond that date. Where a new fibre network is added to a ratepayer’s existing networks and forms art of a single assessment with those networks, which will not be subject to the rates relief, the Valuation Officer will be required to certify the amount of the total rateable value that will be eligible for the 100% relief;that is to say the portion of the total rateable value of the ratepayer’s property that is represented by the new fibre. The ratepayer will have a right to appeal against the value certified in this way if it considers the value to be incorrect. Subject to the certificate, the rates bill will be calculated applying 100%rates relief to the value of the new fibres.

The consultation closes on 21 November 2017. Whilst investment in new fibre networks to improve internet access is very much to be welcomed, we cannot help wondering whether tinkering with the business rates system is the right way of encouraging that investment. There are already more than 15 different types of rate relief in England, and nearly 20 different types of exemption. The system of reliefs and exemptions is very complex and different reliefs interact with each other, sometimes in unexpected ways. The reason that these reliefs and exemptions are needed is because the tax rate is too high. At the time that the Uniform Business Rate was introduced, in 1990, it was 34.8 pence in the pound. At that time Corporation Tax was 34%, basic rate Income Tax was 25%, and higher rate Income Tax was 40%. Business rates then made sense in relation to other taxes. Now, the Uniform Business Rate is 46.6 pence in the pound for small properties, or 47.9 pence for large properties. But Corporation Tax is now 19%, basic rate Income Tax is 20%, and higher rate Income Tax is 40%. Business rates no longer make sense in relation to other taxes, and tinkering with exemptions and reliefs is only a way to try to plaster over an increasingly large crack!