Seldom has the title of a new set of regulations given less clue as to its real purpose! The Non-Domestic Rating (Alteration of Lists) and Business Rate Supplements (Transfers to Revenue Accounts) (Amendment etc.) (England) Regulations 2018, allow ratepayers, in limited circumstances, to make proposals to alter the 2010 Rating lists in England so as to reverse the effects of the decision of the UK Supreme Court in Woolway (VO) v Mazars LLP (2015).

That decision, which we have commented on elsewhere in these new pages, had the effect of requiring properties that were contiguous to each other, but did not directly intercommunicate (such as adjacent office floors in a multi-let building accessible between themselves only via the common parts of the building), to be treated as separate hereditaments for rating purposes. The effect of this was that, in some cases, valuations for business rates altered significantly, and in others, ratepayers lost entitlement to small business rate relief. In some case these changes took effect retrospectively to 1 April 2010 and led to significant backdated increases in rates liabilities.

To reverse these effects the Government introduced the Rating (Property in Common Occupation) and Council Tax (Empty Dwellings) Act 2018, which we have also commented on in these pages. The Act allows properties which satisfy a definition of “contiguity” to be treated as a single hereditament, where they are occupied by the same person and for a similar purpose. The new regulations now allow ratepayers to make proposals to alter the 2010 rating lists to give effect to this. This is very unusual as those rating lists closed to most proposals made by ratepayers at the end of their life on 31st March 2017, nearly two years ago.

The regulations allow ratepayers (not Valuation Officers) to make such proposals in the period from 17th December 2018 to 31st December 2019. They do this by providing a new ground for proposals, which is that the properties concerned satisfy the definition set out in the Rating (Property in Common Occupation) Act 2018. Such proposals will also need to include information about the dates between which the person making the proposal was the ratepayer for the properties concerned.

The regulations also allow ratepayers who may qualify for exemption from business rates under the Non-Domestic Rating (Nursery Grounds) Act 2018, a measure that we have also commented on in the news pages, to seek to have their properties removed from the rating list.

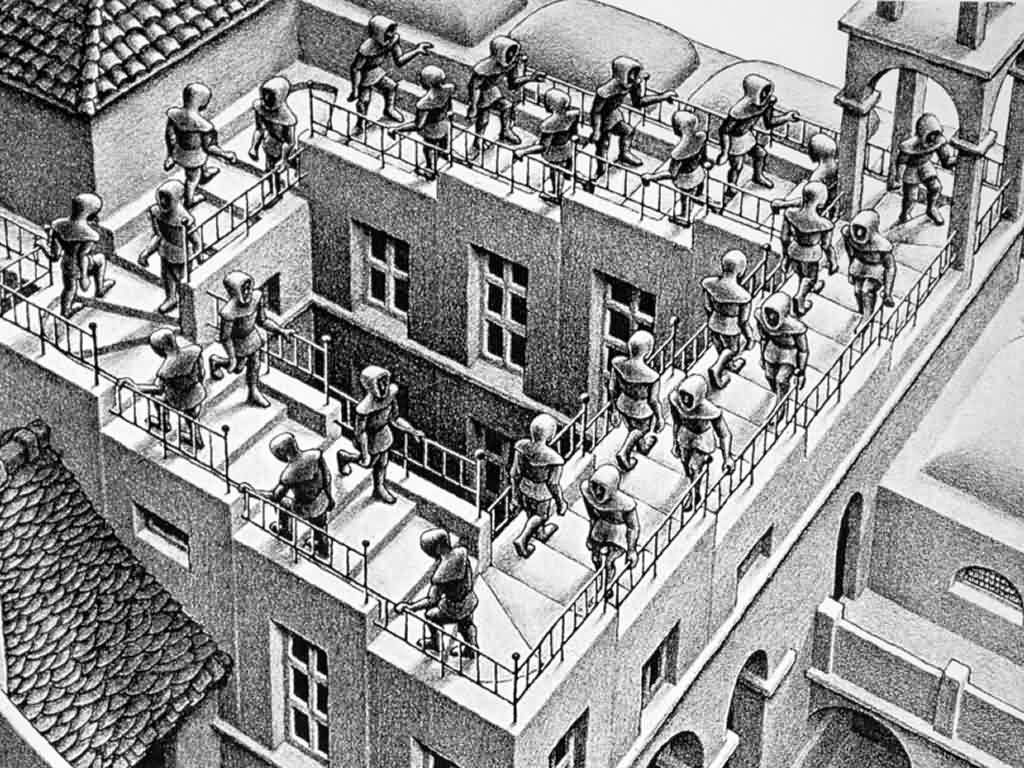

The new regulations will be welcome ones to ratepayers who were affected by significant, and backdated, increases in rates liabilities. But they also illustrate the massive, and ever-growing, complexity of the business rates system with its web of reliefs and exemptions that are so important because of the very high level of the tax. The plethora of new business rates regulations in 2018, some of them such as these, directed at reinstating reliefs or exemptions, is reminiscent of the tale of the small Dutch child who, spotting a leak, in a dyke, put his finger in the hole to plug the leak – only to see another leak spring up nearby. The Government’s latest changes are welcome but are no substitute for a proper overhaul of a creaking system.