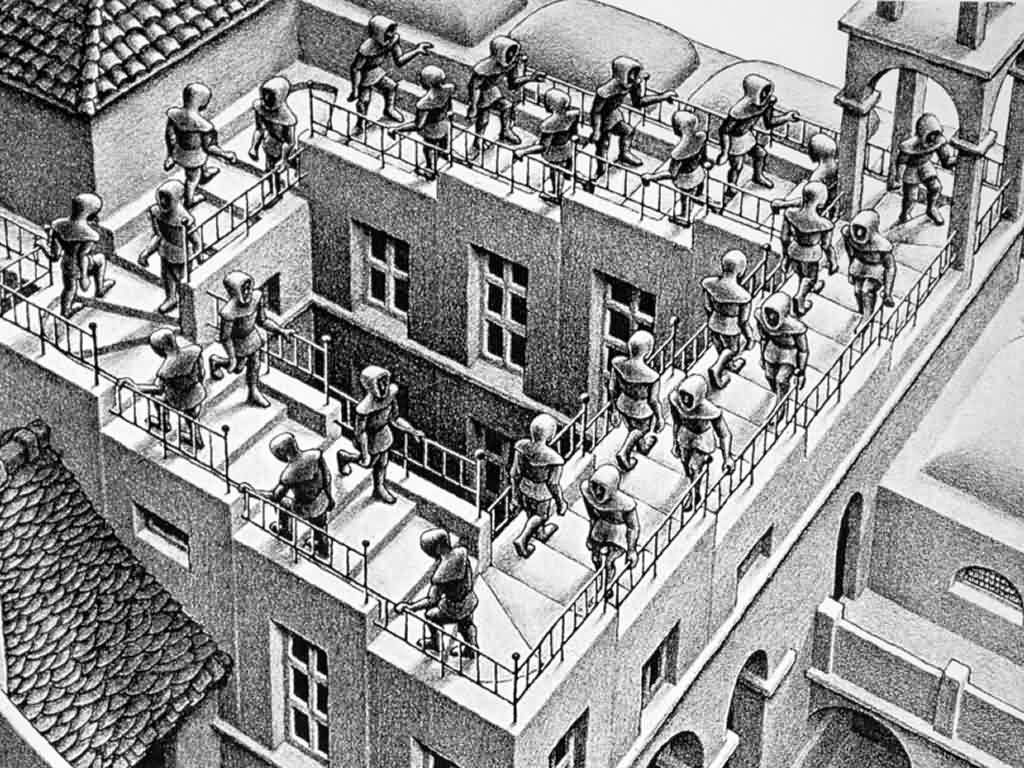

Staircase tax reversal becomes law

The legislation to reverse the effects of the Supreme Court judgment in Woolway (VO) v Mazars LLP (2015) has become law. The Rating (Property in Common Occupation) and Council Tax (Empty Dwellings) Act provides that, where two or more hereditaments occupied or owned by the same person meet certain conditions as to contiguity, those hereditaments may be treated for the purposes of non-domestic rating as one hereditament. ...Read More