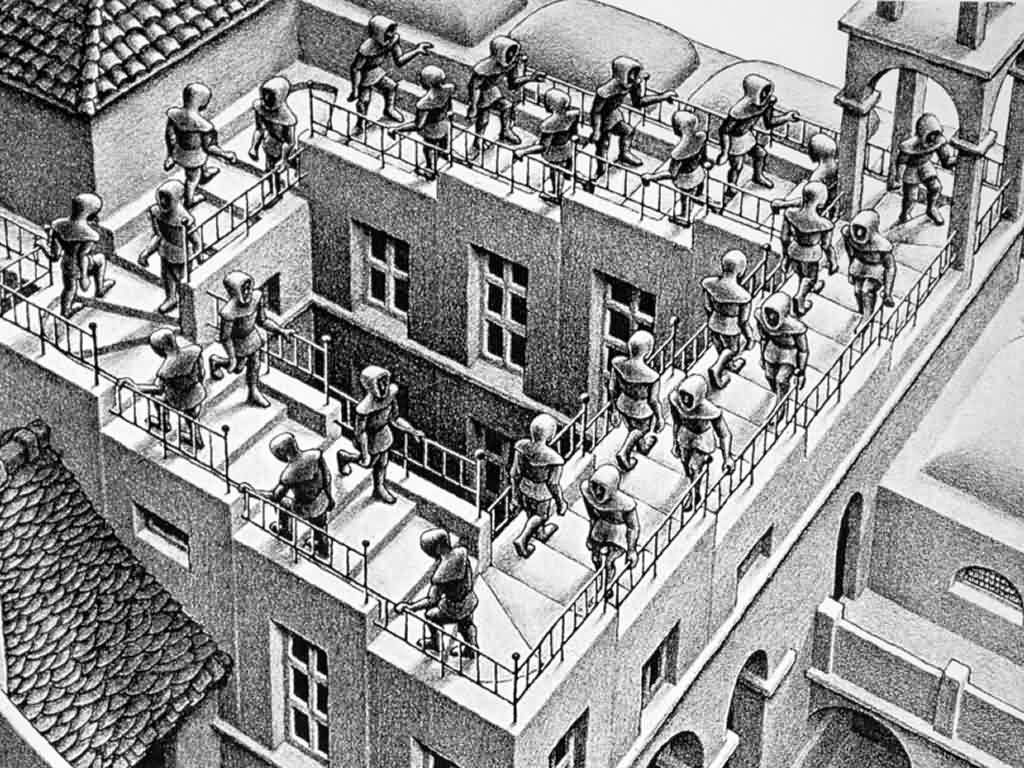

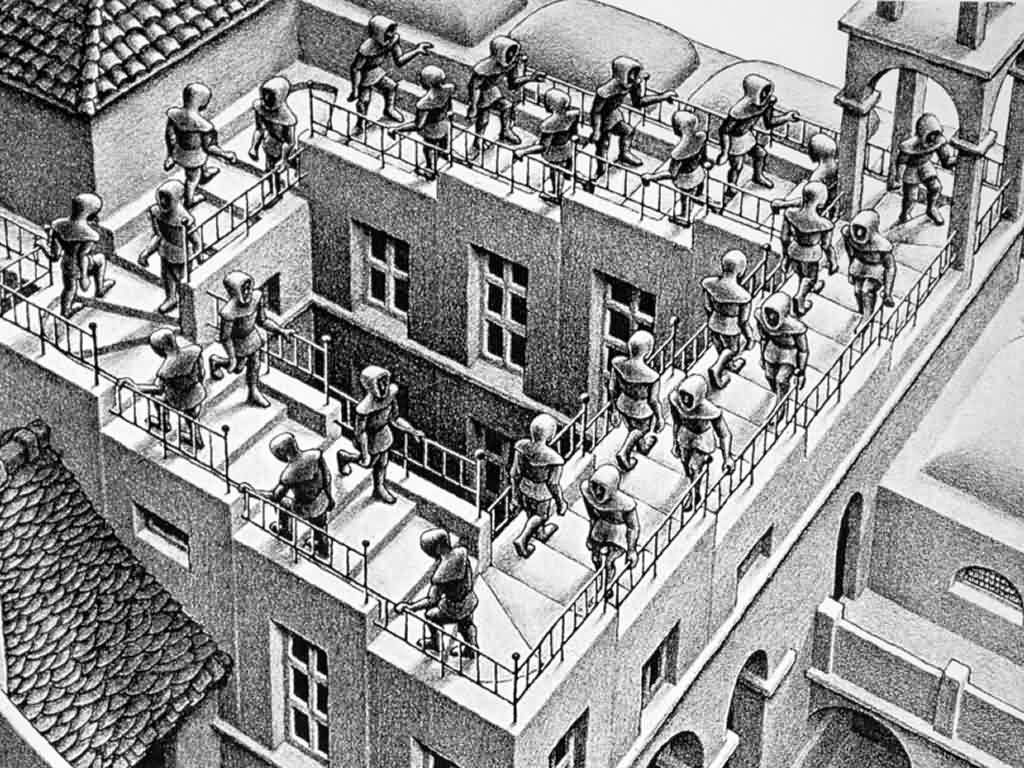

2010 Rating Lists reopened

The government has now published regulations that will enable ratepayers in England who occupy contiguous properties, but which are treated separately for the purposes of business rates, to seek to have those assessments merged in the 2010 rating list. This is the reversal of the so-called "staircase tax". Those rating lists ended on 31st March 2017, but the new regulations will allow proposals to alter them to be made, in limited circumstances, between 17th December 2018 and 31st December 2019. ...Read More

Alton Towers’ rating appeal dismissed

In 2015, following the tragic crash on its "Smiler" ride, visitor numbers to Alton Towers fell significantly. The ratepayer, Merlin Entertainments, sought a reduction in its rating assessment on the basis that the fall in numbers represented a "material change of circumstances". The Upper Tribunal (Lands Chamber) has dismissed the ratepayer's appeal, and its decision offers important guidance on identifying when changes fall within the category of "material changes", justifying an alteration to a rating assessment, and when they do not. ...Read More