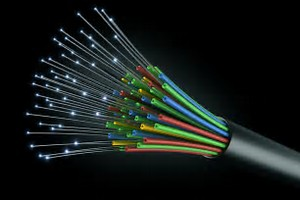

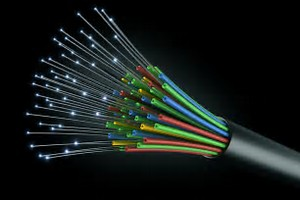

Rates relief for new fibre optic networks

The Government has published a consultation paper seeking views on new regulations that are intended to grant rates relief to new fibre optic telecommunications networks installed after 1 April 2017. This relief was announced by the Chancellor in the 2017 Budget and will offer 100% relief for a five year period from 1 April 2017. The aim is simple, to encourage investment in new fibre optic networks, but the consultation and the draft regulations show how complex and convoluted are the exemptions and reliefs from business rates. ...Read More

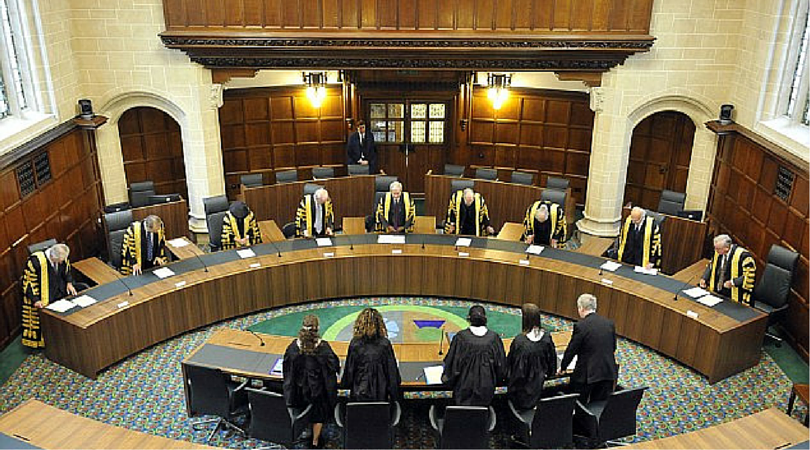

Review of Business Rates in Scotland

Scottish Government has published the Report of the Barclay Review of Non-Domestic Rates in Scotland. The review group was chaired by Ken Barclay, former Chairman of RBS, and spent over a year taking evidence from ratepayers, local authorities and others. Its report makes thirty recommendations, designed to enhance and reform the non-domestic rating system in Scotland. If accepted by Scottish Government some of these reforms could come into effect immediately, whilst others would require new legislation to enable them to be implemented. ...Read More